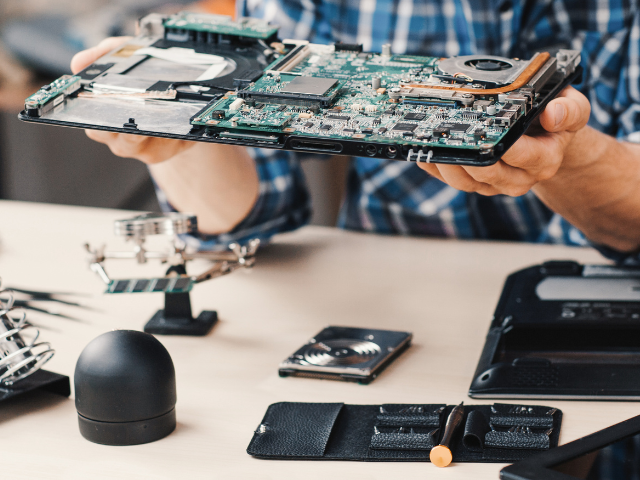

Website Closers® presents an established 21-year-old brand that recognizes and meets a particularly common demand of the digital age: Device Repairs. They offer a vast number of service offerings in both on-site and in-shop capacities, with these options making up the brand’s two major revenue streams. And even after 21 long years in business, still today they see strong year over year growth in top and bottom line – a testament to the strength and longevity of the brand.

Their on-site service is performed directly at clients’ locations, such as businesses, enterprises, offices, and homes. In-shop repairs, meanwhile, take place at one of the brand’s 3 Manhattan locations, which enjoy the benefit of low rent and flexible leases across the lower, middle and upper portions of the island. By operating in the New York area, they have access to the vast number of potential clients to be found there, which is important for growth in both the services currently offered, but also any ancillary services that a new owner might want to bolt on.

The brand dutifully strives to meet client expectations, providing them with quality service that keeps them coming back for their repair needs. They have glowing 5-star reviews across Yelp and Google, and since they launched their warranty protection plan in 2021, they have gained nearly 1,600 active recurring customers, giving them a recurring revenue rate of 17%. They also boast 33% Net Profit Margins, and a 15.32% CAGR, all with a modest churn rate of 3.5%.

They see stable revenue year-round due to customers’ devices failing regardless of season, and their average contract size falls in at around $180 a year. Their subscriber lifetime value reflects the number of clients who have decided to make them their go-to repair professionals, sitting at $483.90.

Business Broker Takeaways:

Scale Opportunities

An ambitious buyer will be pleased to find that, while this acquisition is a veteran of their industry, they could be taken even further up the ladder in the right hands. They could start by expanding their available services, giving them more to offer new and old clients alike and, in turn, making it easier to build upon their existing client base.

They could improve the customer experience by reformatting the brand’s online calendar into an Uber-like system where clients can see when techs are arriving, as well. This hypothetical system could be made more admin-free to allow techs to take payments on the spot, cutting out the after-the-appointment billing.

The brand is an active vendor for government contracts, which presents a lucrative opportunity to boost their revenue if they invest the time and resources to better support these contracts. They could accomplish this by utilizing another department or resource.

One of the best methods that the buyer could use to scale the company, however, would be to focus on more focused and aggressive marketing tactics. They could lay the groundwork for this by adding additional sales representatives and/or additional well trained and skilled employees to the business, and, from there, launch a proactive cold calling strategy or an online advertising strategy.

Their improved advertising strategy would be helpful in marketing to certain promising client demographics like bulk repair & company support, or promoting specific services such as their IT onsite support and their warranty protection plan.

Conclusion

Electronic devices have rapidly become a staple of modern everyday life, making services that keep them running smoothly vital for many consumers. This seasoned brand saves their clients’ money that would otherwise be spent on turning to some of their larger competitors, or even a new device entirely. Their experience in the field and established reputation sets them apart as a trustworthy alternative to Apple or the Geek Squad and gives them opportunities to significantly grow and expand with the right strategies.

This Tech Company is Represented by:

WebsiteClosers.com

Technology Business Brokers

WC 3331